The determination of sales is one of the essential tools for decision-makers in companies. The sales forecast is the dominant size in the budget and ultimately decisive for the question: How many sales must for which cost budget achieved? Only those who know this can plan realistically, set high goals, and successfully manage a company.

But making realistic forecasts is not an easy task.

In this guide, we explain in detail how you can be sure that your sales planning and sales forecasts are as accurate as possible.

The revenues (including revenue) refers to the sum of all goods sold by a company. All funds and claims that arise from the sale of products or services are included in the turnover. It shows how much money a company has made.

Calculate sales: how does it work?

The formula for calculating sales is straightforward: you simply add up all the income. So everything you bill others and goes to your account or checkout. The result is sales, also called revenue.

What are the sales forecasts?

Sales forecasts are used to predict the sales that individual sales employees, teams, or companies are likely to achieve in a certain period. They help with planning, setting goals, and controlling economic success. They also serve for reporting to the company management as well as members of the board and/or shareholders.

Profit and break-even point

The turnover should not be confused with the profit:

The sales tell you how much money you take without asking how much you have spent.

You get the profit if you deduct all of your costs from sales.

The break-even point is particularly relevant in connection with sales and profits. It denotes the point at which purchases and costs are the same. If it is exceeded, there are profits; if it is undershot, there are losses. The break-even point is, therefore, also called profit threshold or benefit threshold.

The break-even point gives you the answer to the question: How much turnover does my company have to generate to cover the fixed costs?

Why are sales forecasts so crucial in your sales planning?

A key advantage of sales forecasts is that they can help identify potential problems relatively early. And that is fundamental to your success because the sooner you learn about a problem, the more likely you are to choke it. For example, sales managers need to find out at an early stage if their employees are having trouble meeting their quotas.

The sooner they become aware that, for example, one of their competitors is threatening to entice their customers away with generous discounts, or that they should revise their new remuneration model because it hurts the motivation of their employees, the better.

Revenue forecasts are also needed to make various decisions – from hiring new employees to resource management to planning goals and budgets.

For example, if your forecast predicts a 26 percent increase in sales opportunities, it would be conceivable to hire additional staff to meet increasing demand. Conversely, it would make sense to temporarily put any recruitment measures on hold should a decline become apparent.

Such a forecast may also suggest investing more in marketing campaigns and/or training your employees on customer acquisition to reverse the negative trend promptly.

Sales planning is a motivation tool

Based on sales forecasts, you can check the progress of your team weekly and compare it with your planning so that you and your team always have an overview of the current status. For employees who have a performance improvement plan in place, it is even a good idea to record their progress daily to prevent them from falling behind.

As mentioned earlier, you should do everything you can to make accurate forecasts. However, this does not mean that you have done something wrong if your assessment ultimately does not fully match your results. In fact, slight deviations are to be expected; after all, you cannot see clearly.

It only becomes problematic when there are apparent discrepancies. But as long as your sales planning is based on reliable data and you choose the right method (see below), your forecasts will provide you with reliable data on how you can effectively grow your business.

Create a sales forecast: Requirements for realistic sales planning

To create accurate sales forecasts, you need the following:

- Sales targets (at team and employee level)

- These serve as an objective yardstick for the neutral assessment of the performance of your employees.

- Clearly defined, documented sales process

- To be able to predict the likelihood of business deals realistically, all salespeople must follow the same process and a fixed sequence of steps.

- Uniform definitions of the lifecycle phases that your contacts go through

- The admission criteria for your individual lifecycle phases (e.g. potential customers, leads, opportunities, customers) must be clearly defined.

- A CRM system

- To be able to make accurate predictions about the probability of business deals, CRM is required, in which the individual interactions with contacts can be correctly understood.

- Shared responsibility

- If sales reps don’t meet their quota, you should try to get to the root cause.

- Are your employees not motivated enough, or are they missing something important in the sales process?

- Are there any blockages?

- If the situation occurs more frequently, you should examine the set goals to see whether they are realistic at all and adjust them if necessary.

Important factors that influence sales forecasts and sales planning

There are several factors to consider when making sales forecasts.

1) Internal factors

- HR decisions

- If you lose employees and cannot replace them quickly enough, you should expect corresponding losses in sales in your next forecast. Conversely, you should be able to plan a significant increase after you have expanded your sales team by a few employees.

- Policy changes

- Note that changes such as the introduction of a new compensation model can affect the performance of your sales staff.

- For example, if you introduce that your salespeople are deprived of commission if customers drop out within the first four months after closing, your sales will temporarily decrease. Because your employees will then only sell to customers whose requirements your products fit perfectly. In the long term, however, this measure will significantly reduce your churn rate so that you can expect an increase again about a quarter later.

- If you stipulate that your sales staff can only grant discounts until mid-month, the closing rate will be significantly higher in the first two weeks of a month and then fall below the previous value in the remaining two weeks.

- Responsibility changes

- When sales reps move to another area, it understandably takes a little while for them to get used to their new area of responsibility, and their pipelines are slowly filling up.

- In this case, a temporary decline in the completion rate would be expected. But if you have planned the change well, it should recover quickly.

2) External factors

- competition

- Companies do not operate in a vacuum, so the successes and failures of their competitors can also have an impact on their results.

- If one of your competitors offers generous discounts, you may have to catch up to prevent customers from migrating. Conversely, the demand for your products will likely increase if one of your competitors disappears from the market.

- Economic situation

- The better the financial situation, the more willing buyers are to invest. If the case is terrible, on the other hand, you have to expect a longer sales cycle because buyers weigh their investments more carefully.

- Market developments

- The behavior of your customers can affect the demand for your products. For example, companies that specialize in advising hotels should always be aware of the current trends in the tourism industry.

- Industry developments

- This applies, for instance, to complementary products, i.e., products that are in demand because they complement each other. If the price of one product falls, the need for the other increases. An excellent example of this would be computers and software.

- Changes in the law

- Since changes in the law can have an impact on the demand for your products, you may also have to take them into account in your forecasts.

- Product changes

- If you introduce a new function, a new pricing model, or additional products or services, this will probably have a positive effect on your sales – in the form of a higher average order volume, a streamlining of the sales cycle, or an increase in business transactions.

- Seasonal factors

- Depending on who your customers are, they may buy more at certain times of the year so that you may have generally stronger and weaker quarters.

Sales planning: Excel and other tools help

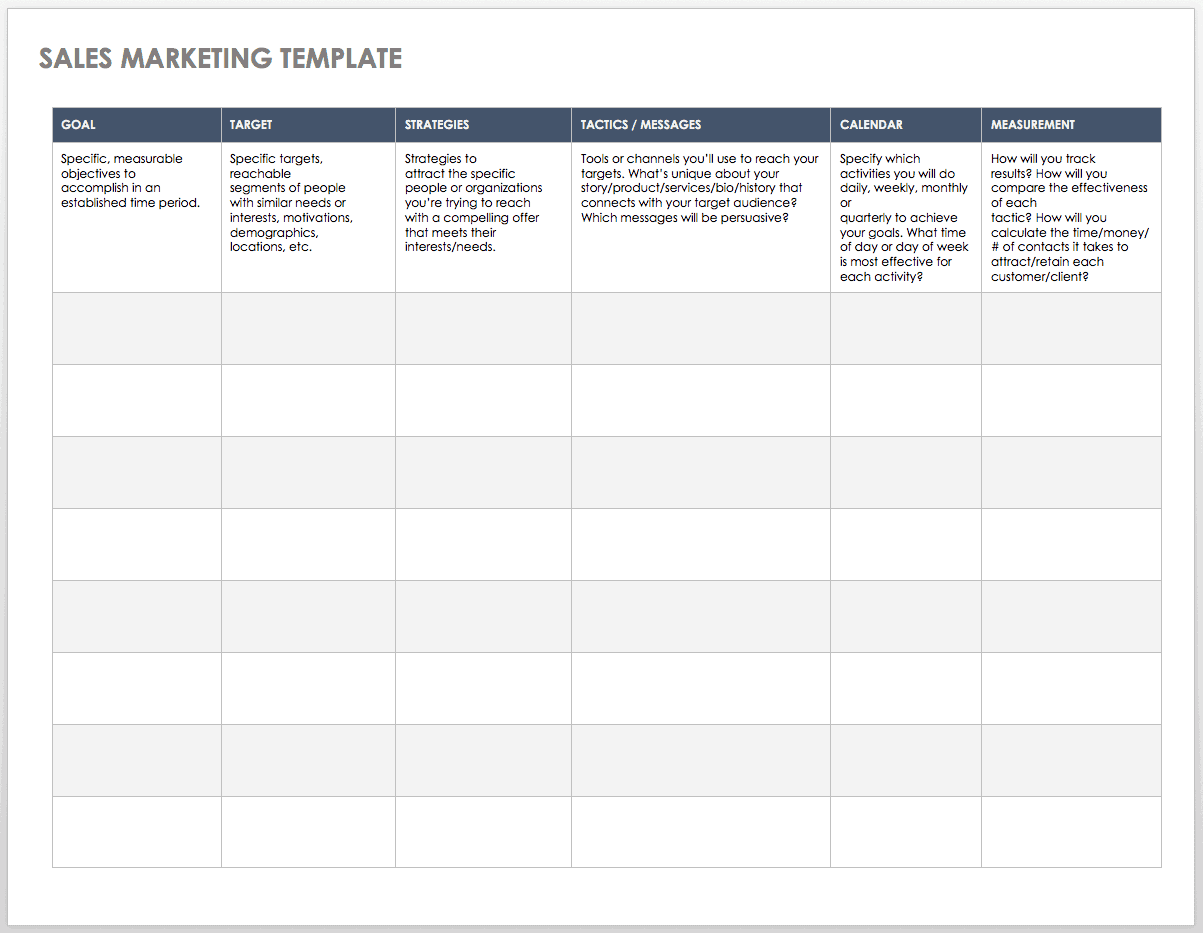

There is various (fee-based) software for sales planning, but Excel can already be a solid start here. Because the numerous templates that are often offered free of charge on the Internet can be of particular service to start-ups and freelancers when starting their sales planning.

For most templates, the sales planning tables are already part of a comprehensive financial plan that includes additional items such as taxes, profits, marketing expenses, and more. This also gives you an overview of costs and revenues that goes beyond sales planning.

Especially when you are at the beginning of your financial planning, the advantages of ready-made formats and tools are obvious: You can start right away without having to worry about the structure of the sales plan and then step through the individual items step by step to let. You just have to fill it out.

What may still be possible independently in sales planning becomes significantly more demanding when it is integrated into a larger financial plan. Finished formats help you – and since they provide different calculation models, the right format for your business model may already be included.

So our tip is that you look for a template for sales planning that you can work into. Excel may be sufficient for smaller companies, but with larger and more comprehensive financial plans, it may be worth switching to one of the software that offers more options and is usually more intuitive to use.

Sales planning and forecasting methods

- Forecasts based on the progress in the sales process

- Forecasts based on the average length of your sales cycle

- Forecasts based on empirical values

- Forecasts based on comparative data

- Predictions based on various factors

- Predictions based on custom variables

All of these methods offer different advantages, and which approach is appropriate in a particular case depends on various factors.

1) Forecasts based on the progress in the sales process

With this method, you calculate your forecast sales based on the likelihood that contacts will become customers in a certain phase.

The following applies: The further customers have progressed in their purchase decision process, the higher the likelihood that it will be concluded.

If you assume that the purchase is 100 percent, you could weight the agreement of the first analysis interview with 10 percent and planned product presentations with 30 percent.

To forecast your sales for a certain period – be it a month, a quarter, or a year – multiply the potential order volumes for all contacts in your pipelines by the respective probability of completion and then add all the results.

With a potential order volume of EUR 1,000 and a probability of completion of 40 percent, this results in a forecast turnover of EUR 400.

In this way, forecasts can be created quite easily and quickly, but they are also correspondingly inaccurate. Because here it is ignored how long contacts have been in your pipelines.

In this way, all contacts with the same closing date are weighted equally – regardless of whether the first contact was made a week ago or three months ago. So you should be able to rely on your salespeople keeping their pipelines up to date, which is not always realistic.

Another disadvantage of this method is that current internal company developments are not taken into account. If, for example, you make changes to the communication with contacts, products, or your sales process, this can also change the likelihood of completion that previously applied to the individual phases of your sales process.

You also need extensive data on the interactions with your contacts to determine these probabilities. Otherwise, your forecast is more of a guess.

2) Forecasts based on the average length of your sales cycle

With this method, too, you base your calculations on the probability of completion. In this case, however, you determine this based on how much time has passed since the first contact about the average length of your sales cycle.

If your sales cycle is an average of six months long, the probability of closing contacts that have been in your pipelines for three months would be around 55 percent using this method.

One of the advantages of this method is that you leave out the subjective assessment of your sales staff, which automatically makes your forecasts more objective. Because you don’t calculate the likelihood of completion based on the progress of the sales process, it doesn’t matter if salespeople in some cases accidentally move on to the next step too early.

It is also no problem with this method to include several sales cycles of different lengths. Depending on how you won leads, it can take a long time for you to make a decision. This can take around six months for typical inbound leads, perhaps only one month for leads who have been recommended for your product and eight months for leads that have become aware of you at trade fairs. To take this into account, all you have to do is make sure to categorize your contacts by sales cycle length.

It’s important to be able to track exactly when and how leads were added to your sales reps’ pipelines.

Here it is advisable to use a CRM system that can be integrated with your marketing software so that all interactions are logged automatically. Otherwise, your sales reps will have to manually document each step they take, which would take an enormous amount of time.

3) Forecasts based on empirical values

You can also simply ask your sales staff for their assessment.

This has the advantage that you take into account the experience of your sales staff – and they know their customers best. However, caution is required here. On the one hand, the sales staff could be a bit too optimistic, and on the other hand, you have no way of understanding their assessments.

Because you would have to have been involved in the entire sales process, i.e., in every phone call, meeting, or all written communication.

Therefore, this method is mainly useful in cases where there is little or no data, for example, for young companies or after the introduction of a new product.

4) Forecasts based on comparative data

If you need a rough forecast as quickly as possible, you can simply see what sales you generated in the same year (month, quarter, or year) in the past year and then assume that you will generate at least the same sales this year.

So if your team had generated monthly recurring sales (MRR) of 80,000 euros last year in October, your forecast for October this year would be at least 80,000 euros.

To make this forecast somewhat more reliable, you could also take into account sales growth. So if your turnover increases by an average of six to eight euros per month, you would cautiously forecast a turnover of 84,800 euros for November.

However, this method has some shortcomings. For one thing, external factors, such as the economic situation, are not taken into account, so that your forecast would be void if industry-wide sales were to fall in November.

On the other hand, you automatically assume that there is a constant demand for your products, but this does not necessarily have to be the case. In summary, it can be said that this method only works as long as no unexpected event occurs, and the market is not saturated in the foreseeable future.

Therefore, it is best to use comparative period data only as an approximate measure and not as a direct basis for forecasts.

5) Predictions based on various factors

To get reliable forecasts, it is advisable to consider several factors at the same time, including comparative data, the average length of the sales cycle, the probability of closing based on the progress in the sales process, and also the performance of your individual sales staff.

Here is a simplified example to illustrate this: You have two sales employees, both of whom are currently serving one customer. Employee A has arranged a meeting with her customer’s purchasing manager for Friday, and employee B has just had a meeting in which he presented a product to his customer.

Also, in case A, the progress in the sales process, the relatively large potential order volume, and the number of days remaining until the end of the quarter result in a probability of 40 percent. The forecast turnover is 9,600 euros.

Employee B is still at the beginning of the sales process, and the order volume is lower in his case, but his completion rate is relatively high. This results in a closing rate of 40 percent for him, and sales of 6,800 euros can be expected.

Now you only have to add these two numbers – EUR 16,400 – and you already know what sales you can expect in the next quarter.

Of all the methods mentioned here, this usually gives the most accurate result. The downside is that you need a top-notch analytics tool with rich features, and that can be a problem for companies on a budget. And even if you have an excellent tool, this will only help you if your sales staff document the progress of their contacts conscientiously. Otherwise, your data will not be reliable, nor will your forecasts.

6) Predictions based on user-defined variables

With this method, too, you base your calculations on completion probabilities, but in this case, they are calculated based on user-defined variables. This means that you can also take factors such as the completion rates of your individual sales employees and the respective potential order volumes into account. Again, it is advisable to use appropriate software, since the manual effort would be (too) large.

If your sales team typically completes deals in a range between $ 5,000 and $ 8,000 over 60 days, then you could increase the likelihood that all of the current deals in your team’s pipeline that fall into that sales category will also close during that period be brought up as very high. You can then use this data to create a monthly or quarterly forecast.

And as always, your forecasts are only as accurate as of the data on which they are based. It is, therefore, crucial that your sales staff document all interactions in your CRM system. Otherwise, your forecasts will lose significance.

A CRM not only helps you to keep an overview of your current sales and sales goals. You can also automatically log all information about contacting potential customers (emails, calls, social media interactions) – exactly the data you need to determine the likelihood of business deals as accurate as possible.