Amazon started off as a ridiculous idea: to sell books over the Internet. Today, it’s an e-commerce giant that can bring down the big names in the industry while changing how we shop. Moreover, it is an essential part of the internet backbone. And with his assistant Alexa, it wants to be omnipresent in our future. How could this happen? What can be learned from history?

Amazon’s Milestones

Amazon is breathtaking today. In 2018, the company made $ 233 billion in sales, or around € 205 billion. For comparison, it is almost on par with Germany’s top-selling company Volkswagen (235.8 billion euros).

But when did Amazon get so big? In 2016, Alexis C. Madrigal said in his article for The Atlantic magazine. He sees this as a crucial year and uses a number that Amazon announces in its quarterly reports: how many square meters of real estate the company owns. He visualized that in this graph:

(Source: Alexis C. Madrigal, The Atlantic)

Specifically, according to Amazon’s annual report for 2018, Amazon now has 26.76 million square meters of warehouses, offices, stores, and data centres. 2017 was the year of the most significant growth: 6.93 million square meters were added. That’s more than Amazon 2012 overall (6.79 million square feet). And by that time, the company was already the largest online retailer in the world. Another comparison: Amazon’s real estate holdings are 48 times larger today than they were in 2004.

As Alexis C. Madrigal points out, this tremendous growth is driven above all by more and more warehouses. Amazon just wants to deliver goods to more and more customers faster and faster.

The beginnings of this fantastic company, on the other hand, were more than modest and found, as so often in these stories, in a garage. In 1994, Jeff Bezos Amazon launched as an online bookstore. Initially, the offer should be called “Relentless” (“merciless”). The company was initially registered under the name Cadabra. Then the choice fell on the largest river in the world as a patron saint.

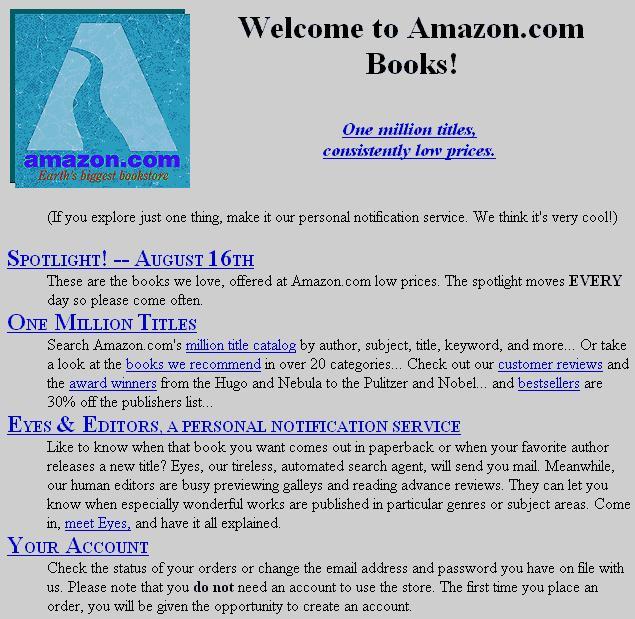

Amazon’s first website (Source: Amazon)

Since then, the digital Amazon has grown a lot: the site has added more than 30 categories.

Some highlights from the story:

- In 1996, the now-famous affiliate program was added.

- In 1997, Amazon went public. In the wake of the dot-com boom, the stock initially gained slowly but was also punished in the stock market crash. But since then she is in a steady upward movement.

- In 2000, Amazon opened for other traders and launched its Marketplace – thanks to a 15% stake in each sale, it was well worth it. Meanwhile, the Marketplace accounts for 40% of shop sales internationally.

- In 2005, the “Prime” membership will be introduced.

- 2007 came the Kindle Reader. He was far from the first reader of its kind. But thanks to the connection to Amazon, the content problem was solved immediately.

- In 2014, the first Amazon Echo will be released.

- In 2014, “Prime Now” will also be presented: If you live in the right region, you can deliver certain goods within two hours – for an additional charge in one hour.

- In 2017, Amazon bought the stumbling organic supermarket chain Whole Foods for almost 14 billion US dollars.

Amazon’s basic principles

Growth is more Important than Profit

A fundamental tenet of Amazon is especially famous among its investors: benefits are not as significant as growth. The following graphic from Recode shows this very clearly:

Amazon’s sales (red) and profits have very different trend curves … (Source: Recode)

What happens there? Amazon always invests its growing revenues in new ventures. At the same time, it undercuts competitors for whom profits are more important than growth. Nevertheless, Amazon has enough money to buy, for example, the organic supermarket chain Whole Foods, because the company has plenty of cash flow.

In the meantime, Amazon is still making a small profit and is not always in the red. However, the priority remains on growth. For in Jeff Bezos’ words, it is still “day 1” of the company.

The Customers are the Most Important Thing

Ultimately, no investor could complain about the lack of profits, because Jeff Bezos had already announced it unambiguously in his now-famous letter to the shareholders in 1997. So that no one forgets, this letter is also later and again copied to the end of new messages, as here.

Another point is reflected in this letter again: the wishes and needs of customers are the focus. This is called “obsession” (“obsession”), to make no doubt arise. It still says:

“Amazon.com uses the Internet to create real value for its customers, by doing so, hoping to create an enduring franchise, even in established and large markets.” – Jeff Bezos 1997

Think long term

The letter also shows that Amazon is not about short-term, but about long-term goals – some very long-term goals. In the course of this, it is essential to make courageous investments. Some of them would pay off, Bezos wrote. You will learn something from the failures.

Even today, more than 20 years later, such a culture of error is still viewed by many as radical.

Agility pays off

Today, Amazon is not only much more significant, but also more complicated than it was a few years ago. Nevertheless, the company can react relatively quickly to new developments, as Benedict Evans describes in his article. In his view, Amazon consists of two companies: the logistics part and the e-commerce part. Above these two is a radically decentralized organization made up of hundreds of small teams. Jeff Bezos once summed up this principle under the term “two-pizza teams”: the groups should be small enough that two pizzas are sufficient for them as a meal after work.

These teams use standardized tools and systems for their work. Benedict Evans writes:

In Amazon at least (and in theory, at least) you can multiply them by saying “The distinct advantage of a small team is that they can do things quickly within the organization. You can add new product lines without adding new internal structure or direct reports. And you can add them without meeting and projects and process in the logistics and eCommerce platforms. “

The advantage of small teams is, therefore (at least theoretically) that they can multiply quickly. You can add new product lines without having to set up new internal structures. In principle, Amazon could continue to grow without being in the way of oneself.

Such small teams initially get only a tiny budget and a manageable task. Test yourself, get more responsibility, writes Timothy B. Lee.

However, a disadvantage in the words of Benedict Evans is that everything has to be reduced to the lowest common denominator so that this flexible principle works so seamlessly. Amazon can set up wide, but not deep. I will discuss this disadvantage below. Because that gives specialized and smart online shops a chance to stand up to the giant Amazon.

Amazon’s presence

Shop and Marketplace

Of course, Amazon is still an e-commerce offer. However, the success of the Marketplace shows why some observers view the company more as a platform provider. Ever since 2000, Amazon has been open to other dealers and manufacturers. This goes so far that many a startup would not consider any other third-party distribution company, as the example of Wyze shows.

Advertising

Ultimately, Amazon’s website is not just a store and Marketplace, it’s also a search engine. If you want to buy something, it’s not necessarily Google anymore, but Amazon. In this respect, it is only logical that Amazon now offers an advertising service that is very similar to Google Ads. At the same time, of course, Amazon knows a lot about its customers. These include obvious things like the place of residence. But also from the orders themselves can be derived surprisingly much, which in turn can then be used for targeted advertising.

A concrete example from practice: A manufacturer of low carbohydrate snacks already knew which other products his potential customers buy. Via Amazon, the company was able to reach precisely these people with its advertising and achieved a fabulous conversion rate of 20 per cent, as the New York Times reports.

In the US, Amazon has now risen to number 3 behind Google and Facebook when it comes to digital advertising. Of course, 4.15% market share still looks modest to Google (37.14%) and Facebook (20.57%). But due to its database, Amazon has a real chance to expand its position here.

An indication: According to a survey by marketing specialist Catalyst, only 15% of companies felt that they already had enough resources on Amazon’s ads. 63% said they wanted to increase their investment.

And it’s not just companies that sell products on Amazon, the New York Times continues. Companies like Verizon, AT & T and Geico have also increased their advertising spend on Amazon. At the same time, it’s not all about digital advertising: companies are also experimenting with ads on Amazon packages. The growth potentials seem enormous.

In addition to the ready-to-buy target group and often accurate targeting, there is another argument for this: Brand Safety. While platforms like YouTube regularly struggle with scandals, Amazon’s website is a relatively secure and regulated environment.

Private Labels Like Amazon Basics

In the meantime, the “Amazon Basics” brand is no longer just about simple things like cables, but also this microwave, for example. (Photo: Amazon)

In the meantime, the data from searches, sales and valuations are no longer used by Amazon to optimize its own page or to deliver advertising.

The shop increasingly produces its own goods. Products with the “Amazon Basics” logo can be found in more and more categories. For some manufacturers and retailers, it is, therefore, a queasy feeling to sell on Amazon or advertise: Finally, the platform earned not only with but also learns.

Above all, manufacturers and dealers with cheap, easy-to-produce and many sought-after products must be careful here. Because what globalization allows them is also their Achilles heels. Amazon can also commission it, doing it all right, what customers complain about other offers and undercut them because of the sheer size of the price.

But there is not only Amazon Basics: for example, the company also has its own footwear and apparel brands. And it is often not visible from the outside that it is an Amazon house brand.

Alexa and Echo

With the Amazon Echo, the company has created a new product category and brought its assistant Alexa into many households. (Photo: Amazon)

Initially, the Smart speaker Echo was not taken quite seriously. Meanwhile, he has started a whole device category. Competitors like Google or Apple try with varying degrees of success to catch up.

At the same time, the voice assistant Alexa is not limited to the in-house devices. Amazon offered him as a platform, and suddenly he found himself in numerous products from various providers. With “Skills” the functionality can be extended by anyone interested.

Basically, Amazon has done with Alexa, what Google has previously done with Android. It wanted to secure its place on a new platform, so it offered a free solution for it. The search and advertising giant Google copied now this copied from his approach – with extensive use of money.

Whether Alexa is worthwhile for Amazon, however, is so far open. Few users seem to buy it yet. But as stated above: Amazon thinks long term. What is still a niche today can turn into a lucrative business in three, five, seven years.

Kindle

With the Kindle readers and e-book store Amazon has turned the area and mostly won for themselves. Especially since a flat rate was introduced with Kindle Unlimited, this had unusual side effects: A lively scene of independent scribes and publishers was created here. Even in Germany, some people earn something with it, and some can live on it completely.

And even if not everyone likes to buy a device just for reading, the Kindle app is, of course, present on all major platforms. With the “Fire Tablets,” once tried to push into this market. How successful they are is unknown.

Other Hardware

Also, under the “Fire” brand appeared a finally flopped smartphone. Amazon probably did not rely on its own data when it was developed. And “Fire TV” devices are part of it, with which you can turn any TV into a smart TV (which then, of course, readily cooperates with Amazon’s offers). The turn seems popular and successful, as far as can be judged from the outside.

Amazon also likes to buy suitable startups. Blink, Ring or even Eero are among them and all point in one direction: Smart Home. Here again, comes the digital assistant Alexa including the Echo product family into play: they act as a central switching point and implement commands on demand.

Smorgasbord Amazon Prime

Basically, Amazon Prime is nothing more than a subscription or membership business model: you pay an annual price and have exclusive benefits. So you pay for an unusually fast delivery no longer extra. At the same time, Amazon is continually adding new content and offers. So you have here Netflix competitors, music streaming and more.

The idea is: Something will get you to become a prime customer. And then there will be enough offers that you will not cancel it off so quickly. Platform Lock-In is what you call it: you put yourself in a company’s plush cage.

And that works: In the US, according to analysts, more than half of all Internet households at the same time be prime members, as the Wall Street Journal reports. As research shows, Prime customers also order more the longer they are a member. And why look for alternatives, if you have already paid for Amazon’s service in advance?

AWS

A separate article introduces Amazon Web Services in more detail. Basically, they started as a side project: Amazon switched its technical infrastructure to a new, more automated, global and flexible system. At the same time it was thought: why not offer some of these capacities for money? Meanwhile, AWS contributes about 10 per cent of sales and nearly half of all profits. Many market observers had initially bet that it would be losing business for Amazon.

While it was initially favoured by startups, there are now more and more prominent names among customers – even competitors like Netflix.

Logistics

Cargo plane “Amazon One” (Photo: Amazon)

Amazon looks at every single part of its business to find optimization potential. At the same time, the company is simultaneously thinking of new platforms that can be offered to others. Of course, logistics are part of that: Not only does Amazon now have a breathtaking amount of storage space.

It also has its own delivery service from the delivery van to the cargo plane. With the “Amazon Locker,” it has a competitor to DHL “Packstation” on offer. And with delivery robots, the next long-term bet on the future is already on the way.

Besides, Amazon does not just want to use it all for itself. Dealers can now use the storeroom and shipping via Amazon (Fulfillment by Amazon, FBA). As a result, the company can plan projects like new warehouses from the start, earns some of those offerings, and at the same time makes the customer experience better. After all, shipping through Amazon can rely on getting the same quality as goods. Which Amazon offers itself.

Shops

Free Shop “Amazon Go” in Seattle. (Photo: Amazon)

Since 2017, as mentioned above, the organic supermarket chain “Whole Foods” with its nearly 500 shops belongs to Amazon. And that’s not all: Amazon plans more stores – both for food and for other goods. It is already experimenting with bookstores and wants to introduce cash-free shops.

For Amazon, that makes a lot of sense, because most of the sales in the trade are still made in physical stores. Also, their customers can be extended via delivery services. And of course, the company can access its data and in turn bring Amazon Prime into play.

This is not surprising. Amazon wants to do more than just dominate online commerce. And food, for example, accounts for 20 per cent of consumer spending, as Ben Thompson explains here. So there is a rewarding business field to find. Why not occupy it and take it to the next level with digital services?

Also, Amazon can use this system around food for other purposes and, for example, become the supplier for restaurants, Thompson speculates. Amazon is not about having stores. It’s about another platform that can be built on – just like the online store, including Marketplace or AWS. Another example might be the delivery service “Amazon Restaurants”, which can also rely on existing structures.

Amazon’s Future

Despite its impressive size, Amazon still has many growth opportunities, even if it’s just about the core business of e-commerce. This is exemplified by two figures: In the US, the company has around half of the e-commerce market in their hands. Overall, however, it represents only five per cent of sales in the trade (without car dealers, restaurants and bars). For comparison: Walmart reaches ten per cent here. However, it seems inevitable that business in the US will migrate more and more to the Internet. In other countries, such as China or South Korea, the share of e-commerce is already significantly higher: 23 and 16 per cent, compared to 10 per cent in the US. Another number: Worldwide, Amazon claims to have only a market share of less than one per cent of the trading volume.

No wonder that Amazon belongs to the many companies that want to develop and deploy autonomous delivery robots. After all, they could not only change online commerce if they enable punctual and fast delivery around the clock. They also have the same potential for brick-and-mortar retailing: On-call delivery is only advisable today for a few goods, such as food delivery services. With autonomous fleets of delivery robots, this could also apply to other purchases.

But of course, Amazon does not automatically fly to customers, as shown in China. The seemingly overwhelming seeming company does not have much to report here.

But that does not stop you from entering many other areas. Artificial intelligence is part of this, but so are augmented and virtual reality. If you want to know more about this, we recommend this very detailed overview in English.

The new Spheres are part of Amazon’s Seattle headquarters. (Photo: Amazon)

Criticism and Stumbling Blocks

But even on Amazon is not all vain sunshine. For example, Amazon’s website and Marketplace have long been a role model and a reason for the company’s success. The site is better suited today as a deterrent example. Dozens of ugly elements compete here for the attention of the user, a hidden object, in which one finds only with difficulty what one looks for. Products and product variants can be found scattered over several offer pages. The search is often difficult to narrow down. Comparisons are possible only with great effort.

Katie Notopoulos describes it at BuzzFeed, Ian Bogost describes similar frustration at the Atlantic.

Amazon also has a problem with fakes or simple fraudsters. One wants to work against that stronger now. But if that is more than lip service, you have to wait and see.

And last but not least, the business is flourishing with fake reviews.

In other words, it becomes increasingly challenging to find precisely what you are looking for. And even if you find it, you can not rely on what you actually get in the end. And that’s a problem that seems to neglect Amazon or has ignored in any case for a long time.

Instead, it focuses on selling the paid Prime membership. Sometimes popular products can even be ordered only for members. That was for me personally the point at which I looked for alternatives and order only at Amazon, if it is actually the best option. Thanks to Amazon’s sales tactic, I’ve come to the attention of B & H here in the US, for example, a likable company based in New York, where I buy everything that has to do with photos, videos, computers and other electronics.

And that shows at the same time: Even if Amazon seems vast and overpowering, other online retailers still have a chance. Just as B & H serves a clearly defined target group, so can the other. Excellent and as personal service as possible, of course, and a well-made website with useful content. In Germany, Thomann is an example of this: a definite niche, helpful information on the site, personal contacts, reasonable prices with prompt delivery. And of course, a specialized online shop has a lot easier to process its product categories in a meaningful and target-group-oriented way than a provider like Amazon, in which a system should reflect everything.

Also, Amazon keeps making headlines because it does not consider ethical business as a priority. Just think of the minimum pay of many employees, while Jeff Bezos puts his billions in front of everyone in rockets. Also, the scramble for the location of the second Amazon headquarters in the US made for some not very friendly headlines. Cities and regions exceeded each other and undercut each other in this spectacle.

Meanwhile, Amazon does not pay US federal taxes on its $ 11.2 billion profit from 2018. Of course, they do not have to. It can be argued that it would be up to the legislator to close loopholes. Or, on the other hand, one could expect a company to voluntarily give back to society without which it would never have been possible. Instead, Amazon, for example, has put its home base Seattle under massive pressure to prevent an additional tax – successfully. The money from it should be used among other things against the growing problem of homelessness. At the same time, Jeff Bezos is extremely stingy when it comes to charity.

The list goes on. Sadly, Amazon, like so many companies, is more interested in their own growth and not much else – unless you can knit a proper press release. It would be beyond the scope of this paper to exhaustively cover this topic.

Conclusion

Amazon is a remarkable company. And you certainly have a lot of respect for Jeff Bezos – at least when it comes to his business acumen. It is amazing how consistently the company is still pursuing what it already described in 1997 in its letter to the shareholders. And it’s also amazing how radically many of the ideas and principles that have made Amazon so successful are still working.

Amazon’s first office (Photo: Amazon)